Germany's AI Manufacturing Pivot: What It Means for Global Business

Germany's position as the industrial engine of Europe has rarely been in doubt, but by 2026 its manufacturing base is undergoing one of the most profound transformations in its post-war history. Long associated with precision engineering, meticulous quality standards, and export-oriented industrial strength, the country is now redefining itself as a benchmark for how advanced economies can embed artificial intelligence and automation into complex production systems without abandoning social cohesion, environmental responsibility, or strategic autonomy. For decision-makers across North America, Europe, Asia, and beyond, Germany's experience offers a detailed, real-world roadmap that aligns closely with the themes UpBizInfo follows every day across business, technology, economy, and employment.

From Industrial Backbone to AI Testbed

Germany's industrial foundation remains anchored in its Mittelstand-the dense network of small and medium-sized enterprises that specialize in high-value, niche technologies, machinery, and components-alongside globally recognized industrial giants such as Siemens, Bosch, Volkswagen, and BMW. These companies, many family-owned and regionally rooted, have historically excelled in incremental innovation, process optimization, and export discipline. However, as the global economy has shifted toward data-driven competition, they have increasingly become testbeds for AI-enhanced manufacturing models that combine cyber-physical systems, advanced robotics, and real-time analytics.

The policy framework underpinning this shift evolved from the AI Strategy 2025 into a broader, updated national AI and digitalization agenda that, by 2026, is tightly aligned with the European Union's industrial and digital policies. The federal government has continued to channel funding into applied research via institutions such as the Fraunhofer Society, the Leibniz Association, and the Max Planck Society, which act as bridges between academic breakthroughs and industrial applications. These institutions collaborate closely with industry consortia and regional innovation clusters to ensure that AI is not an abstract concept but a tangible productivity driver on factory floors in Bavaria, Baden-Württemberg, North Rhine-Westphalia, and beyond. For readers seeking to understand how these structural forces shape global competitiveness, the analyses at UpBizInfo's economy hub provide ongoing context.

Intelligent Robotics and Adaptive Production Systems

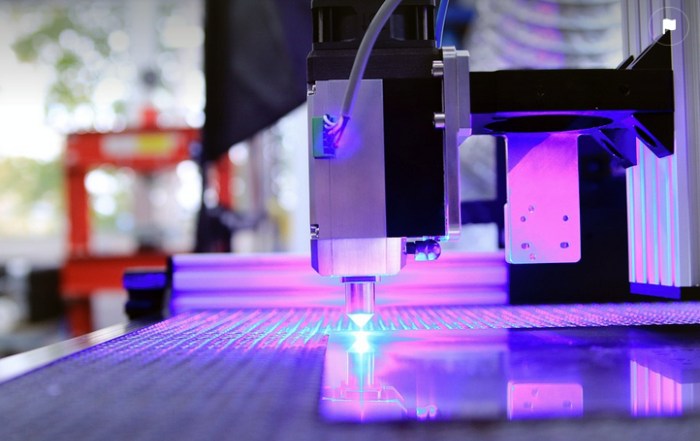

The most visible face of Germany's AI-led industrial transition lies in its factories, where intelligent robots, sensor-rich equipment, and AI-driven control systems are progressively replacing rigid, linear assembly lines with flexible, adaptive production environments. Companies such as KUKA, Festo, and ABB have been at the forefront of integrating machine learning into industrial robots, enabling them to operate safely alongside humans, respond to unstructured environments, and continuously optimize their own performance.

In the automotive sector, Volkswagen and BMW have deployed AI-enabled robotic arms that not only assemble components with micron-level precision but also perform real-time quality inspections using computer vision and anomaly detection models. These systems significantly reduce rework rates, shorten production cycles, and allow for greater product customization without sacrificing throughput. For global observers, this evolution in "mass customization" demonstrates how advanced manufacturing can reconcile efficiency with individualized consumer demand, a theme that is increasingly relevant across industries tracked in UpBizInfo's markets coverage.

Complementing robotics, Germany has become a leader in digital twin technology. Siemens, through its industrial software and platforms such as MindSphere, has pioneered the use of virtual replicas of machines, production lines, and even entire factories. These digital twins are continuously fed with sensor data, allowing engineers and AI models to simulate operating conditions, predict failures, and test process changes before implementing them in the physical world. This approach not only boosts uptime and asset longevity but also provides a granular view of energy consumption and material usage, which is increasingly critical as regulatory and investor scrutiny on sustainability intensifies. Executives wishing to learn more about how such tools are reshaping industrial strategy can explore technology-focused insights in UpBizInfo's dedicated tech section.

Data-Driven Maintenance, Quality, and Supply Networks

Beyond the visible robots and machines, the true transformation lies in how German manufacturers are exploiting data across their value chains. Predictive maintenance has become a mainstream practice in leading plants, where AI models analyze vibration patterns, temperature readings, and operational logs to predict component failures before they occur. This reduces unplanned downtime, optimizes spare parts inventories, and enables more stable capacity planning. Companies such as Trumpf and Carl Zeiss AG have integrated these capabilities into high-precision equipment, allowing for remote diagnostics and performance optimization for customers worldwide.

Quality control has likewise been revolutionized. Machine vision systems, often trained on millions of labeled images, now inspect welds, coatings, and microstructures at a speed and consistency beyond human capability. In sectors like automotive and aerospace, where tolerances are unforgiving and regulatory requirements are intense, these AI-enhanced quality systems have become strategic assets rather than optional add-ons. For leaders interested in the broader implications for global supply chains and trade flows, resources such as the World Trade Organization and the OECD's digital economy reports provide useful complements to the ongoing commentary at UpBizInfo.

Supply chain management, shaken by the pandemic, geopolitical tensions, and energy price volatility, has also become a focal area for AI deployment. German manufacturers increasingly rely on predictive algorithms to model demand fluctuations, simulate disruption scenarios, and dynamically adjust sourcing strategies. Logistics providers such as DHL and DB Schenker have invested heavily in AI-based routing, capacity forecasting, and warehouse automation, enabling German exporters to maintain reliability even under stressed conditions. Readers can deepen their understanding of these global dynamics through institutions like the World Economic Forum and the International Monetary Fund, which frequently highlight Germany's role in resilient supply chain design.

Workforce Transformation: From Displacement Risk to Skills Reinvention

No discussion of AI and automation in Germany can ignore the labor dimension. The country's manufacturing jobs have long been associated with stable, well-paid employment, backed by strong unions and co-determination structures. The integration of AI has inevitably raised concerns about job displacement, particularly in routine assembly, inspection, and administrative roles. Yet, by 2026, Germany's response has become a reference case for how to manage technological disruption through social partnership and proactive skills policy rather than reactive austerity.

Organizations such as IG Metall, Europe's largest industrial union, have negotiated framework agreements that embed worker participation in decisions about AI deployment, data usage, and workplace redesign. These agreements often include binding commitments to retraining, internal mobility, and limits on purely cost-driven automation. The federal and state governments, in coordination with the Federal Employment Agency and the Federal Institute for Vocational Education and Training (BIBB), have expanded programs like "Berufsausbildung 4.0" to incorporate AI literacy, data handling, and human-machine interaction into apprenticeships and continuing education.

Universities and applied science institutions-among them RWTH Aachen University, Technical University of Munich, and Karlsruhe Institute of Technology-have intensified collaboration with industry to create dual-study programs and executive courses focused on industrial AI, robotics, and cybersecurity. For global readers examining how talent pipelines are being reshaped, resources such as the UNESCO education reports and the International Labour Organization provide valuable context. At UpBizInfo, these evolving skills strategies are tracked closely in the employment and jobs sections, where the German case is frequently compared with developments in the United States, United Kingdom, and Asia-Pacific economies.

Sustainability, Energy, and the AI-Climate Nexus

Germany's AI-enabled industrial transformation cannot be separated from its climate and energy agenda. Following the accelerated phase-out of nuclear power and the ongoing reduction of coal usage, German industry has faced some of the highest energy costs in Europe, intensifying the need for efficiency and innovation. At the same time, the country's commitment to achieving climate neutrality by 2045 has placed pressure on manufacturers to decarbonize their operations and supply chains without undermining competitiveness.

AI and automation are increasingly central to this balancing act. Chemical giant BASF has deployed AI models to optimize reaction conditions, reduce waste, and minimize energy usage across its sprawling production complexes, with digital control rooms now monitoring thousands of variables in real time. Automotive leaders such as BMW and Mercedes-Benz Group use machine learning to optimize paint shops, casting processes, and logistics flows, cutting emissions and resource consumption per vehicle. Smaller firms in the Mittelstand are adopting AI-driven energy management systems that adjust machine schedules to exploit off-peak electricity prices and integrate on-site renewables more efficiently. Interested readers can learn more about sustainable business practices through platforms such as the United Nations Global Compact and the World Resources Institute, alongside dedicated sustainability coverage at UpBizInfo's sustainable business section.

The move toward circular manufacturing has also gained momentum. Companies including Henkel and Siemens Energy are experimenting with AI-powered tracking and analytics that follow components and materials through their life cycles, enabling repair, remanufacturing, and recycling at scale. Computer vision systems installed in recycling facilities are now capable of distinguishing between closely related material types, significantly improving sorting accuracy and recovery rates. This shift aligns closely with the European Union's Circular Economy Action Plan and the broader decarbonization agenda outlined by the European Commission. For executives across regions such as North America, Asia, and Africa, these developments illustrate how industrial AI can be leveraged not only for cost reduction but also for regulatory compliance, brand positioning, and long-term risk mitigation.

SMEs, Cloud AI, and the Battle Against the Digital Divide

While large corporations dominate headlines, the true test of Germany's AI transition lies in whether its SMEs-over 99 percent of all firms-can successfully adopt digital tools. Many of these companies, often located in smaller cities and rural areas, excel in highly specialized mechanical or materials engineering but lack deep in-house IT or data science capabilities. Without targeted support, they risk falling behind both domestic champions and international competitors.

To mitigate this risk, the federal government has expanded initiatives such as "Digital Jetzt" (Digital Now), which provides grants and advisory support for SME investments in software, cloud services, cybersecurity, and AI-based tools. Public-private platforms like Plattform Industrie 4.0 and sector associations such as ZVEI have developed practical guidelines, reference architectures, and use case libraries to help SMEs evaluate and implement AI projects. At the regional level, innovation hubs and "Mittelstand-Digital" centers provide demonstrations, training, and matchmaking between technology providers and traditional manufacturers. Global readers can benchmark these policies against digitalization strategies in other regions through organizations such as the World Bank and the OECD.

Cloud-based and "plug-and-play" AI platforms have emerged as particularly powerful enablers. Enterprise software providers including SAP, Celonis, and TeamViewer offer modular solutions that allow SMEs to automate workflows, analyze process data, and optimize logistics without building large internal data science teams. These offerings often come with pre-configured models for predictive maintenance, inventory optimization, or production scheduling, lowering the barriers to entry. At UpBizInfo, the implications of this democratization of industrial AI are explored across technology, business, and founders coverage, where the experiences of smaller firms are increasingly central to the narrative.

Data Sovereignty, Ethics, and Regulatory Leadership

Germany's approach to AI is not solely technical or economic; it is deeply shaped by its legal culture and historical sensitivity to privacy and state overreach. This has led to a distinctive emphasis on data sovereignty, ethical guidelines, and robust regulation, which in turn influences how German manufacturers design and deploy AI systems.

At the European level, the EU AI Act-finalized in principle by mid-decade-establishes a risk-based framework that imposes strict obligations on providers of high-risk AI systems, including many industrial applications. Germany has been a strong supporter of this approach, pushing for transparency, robustness, and human oversight in AI tools used for safety-critical operations, worker monitoring, or environmental compliance. The German Ethics Council and advisory bodies within ministries have played a significant role in shaping these debates, insisting on explainability and accountability. For an overview of these regulatory developments, global executives can consult resources from the European Union Agency for Fundamental Rights and specialized analysis available in UpBizInfo's AI section.

On the infrastructure side, Germany has been a driving force behind GAIA-X, the federated European data infrastructure initiative. Supported by companies such as Deutsche Telekom, Siemens, and BMW Group, GAIA-X aims to create interoperable, secure cloud and data spaces that allow industrial firms to share and analyze data without ceding control to non-European hyperscalers. For manufacturing, this means that machine data, design files, and supply chain information can be pooled for AI training and optimization while respecting stringent data protection rules. This model of "trusted data spaces" is increasingly watched by policymakers in regions as diverse as Singapore, Canada, and South Korea, all of whom face similar tensions between openness and sovereignty.

Investment, Startups, and Strategic Positioning in Global Competition

Germany's AI manufacturing pivot is also reshaping its innovation and investment landscape. Startup ecosystems in Berlin, Munich, Karlsruhe, and Hamburg have matured, with a growing number of young companies focused on industrial AI, robotics, sensor technology, and deep-tech materials. Firms such as Konux (rail infrastructure analytics), ArtiMinds Robotics (robot programming and automation), and Twenty Billion Neurons (computer vision) exemplify how entrepreneurial ventures are plugging into established industrial supply chains. Publicly backed funds like High-Tech Gründerfonds (HTGF) and initiatives such as the Digital Hub Initiative provide capital and support, while corporate venture arms from Siemens, Bosch, and BMW act as strategic investors and first customers.

For global investors, this ecosystem offers exposure to AI applications grounded in real industrial demand rather than speculative consumer trends. The interplay between startups and incumbents is also creating acquisition and partnership opportunities that extend beyond Germany's borders into North America, Asia, and other parts of Europe. Readers interested in tracking these flows can follow updates from the European Investment Bank and the European Investment Fund, while UpBizInfo's investment coverage provides regular analysis of where capital is moving within AI, robotics, and advanced manufacturing.

At the geopolitical level, Germany's industrial AI strategy is deeply intertwined with its relationships with the United States, China, and key partners in Asia and the Indo-Pacific. While German firms remain heavily engaged with Chinese markets and supply chains, concerns about intellectual property protection, export controls, and political risk have driven a diversification push toward markets such as the United States, India, and Southeast Asia. Simultaneously, transatlantic cooperation on standards, research, and security-discussed in forums such as the EU-US Trade and Technology Council-is shaping the regulatory and technological environment in which German AI manufacturers operate. For global readers, UpBizInfo's world section and news coverage contextualize these strategic shifts within broader geopolitical and market trends.

Lessons and Implications for Global Business Leaders

By 2026, Germany's experience with AI and automation in manufacturing offers several clear lessons for executives, policymakers, and investors across continents. First, it demonstrates that technological leadership does not require abandoning social protections; rather, carefully designed training systems, social dialogue, and regulatory frameworks can turn potential resistance into a platform for inclusive transformation. Second, it shows that sustainability and competitiveness can be mutually reinforcing when AI is used to optimize resource use, enable circular business models, and comply with tightening environmental regulations.

Third, Germany illustrates that mid-sized industrial firms can be powerful innovators when they are supported with access to cloud-based AI tools, applied research networks, and targeted public funding. This is particularly relevant for countries where manufacturing is regionally dispersed and dominated by SMEs, from Italy and Spain to Brazil, South Africa, and Malaysia. Fourth, the German emphasis on data sovereignty and ethical AI offers a counterpoint to more laissez-faire or state-driven models, suggesting that trust and transparency can become competitive differentiators in their own right.

For readers of UpBizInfo, these lessons resonate across multiple areas of interest. They affect how banks and financial institutions evaluate industrial credit risk and innovation lending, topics explored in our banking coverage. They influence how marketers position "Made in Germany" products in markets like the United States, Canada, Australia, and Asia, a theme running through our marketing insights. They shape labor market dynamics, job design, and career planning, all central to our employment and jobs reporting. And they intersect with broader debates around crypto, digital infrastructure, and the future of work that we track across our AI, technology, and economy sections.

A Forward-Looking Perspective for 2026 and Beyond

As the world moves deeper into the second half of the 2020s, Germany's AI-powered manufacturing landscape will continue to evolve under the pressure of global competition, climate imperatives, demographic change, and geopolitical uncertainty. The country's ability to maintain its industrial edge will depend on sustaining investment in research and infrastructure, managing energy transitions without eroding competitiveness, and continuously updating skills and regulatory frameworks to keep pace with technological change. For global stakeholders-from factory owners in the United States and policymakers in Singapore to investors in London and founders in Seoul-the German case offers an ongoing, real-time experiment in how to steer industrial transformation toward long-term resilience rather than short-term disruption.

At UpBizInfo, this story is not treated as an isolated national narrative but as a lens through which to understand broader shifts in global markets, cross-border investment, and the future of work and technology. As AI continues to blur the boundaries between digital and physical production, Germany's blend of engineering tradition, ethical governance, and collaborative innovation will remain a critical reference point for leaders across Europe, North America, Asia, Africa, and South America who are seeking to navigate the next phase of the industrial revolution with confidence and foresight.