Geopolitical Risk Management in Global Trade: Turning Volatility into Strategic Advantage in 2026

Global trade in 2026 is defined by a level of geopolitical complexity that far exceeds traditional concerns over tariffs, customs procedures, and shipping routes. International commerce is now deeply entangled with national security priorities, technological sovereignty, climate policy, cyber defence, and shifting political alliances. For executives and investors who follow UpBizInfo and rely on its perspectives on global business, this new environment demands a more sophisticated and integrated approach to decision-making, where geopolitical risk management is treated as a core strategic capability rather than a peripheral compliance task.

As trade disputes between major economies persist, technology rivalries intensify, and regional conflicts reshape energy and commodity flows, companies across the United States, Europe, Asia, Africa, and the Americas are forced to rethink how and where they operate. Sanctions regimes, export controls, data localisation laws, and national security reviews have become central determinants of market access. At the same time, the acceleration of artificial intelligence, digital finance, and green technologies is redrawing the map of competitive advantage. Organizations that understand these dynamics and embed them into their strategies can protect supply chains, preserve reputations, and identify opportunities that less-prepared rivals overlook.

For UpBizInfo readers, who are particularly focused on AI, banking, crypto, employment, investment, and global markets, this shift is not theoretical. It affects where capital is deployed, which technologies can be commercialised, how jobs are created or relocated, and which markets will offer sustainable growth over the coming decade. The most resilient companies are those that treat geopolitical awareness as an essential building block of long-term value creation, integrating it into planning, capital allocation, and operational design rather than reacting only when crises erupt.

The Evolving Nature of Geopolitical Risk in Trade

Geopolitical risk in trade has expanded from traditional concerns such as coups, wars, and tariff disputes to a broad set of interlinked issues that cut across security, technology, finance, and regulation. Political instability in emerging markets can still disrupt operations and endanger assets, but it is now joined by sophisticated sanctions regimes, contested maritime routes, weaponised supply chains, cyber espionage, and the use of trade policy as a tool of industrial strategy. These factors shape everything from commodity prices to cross-border investment approvals and are increasingly visible in global indices and outlooks published by organizations such as the International Monetary Fund and the World Bank.

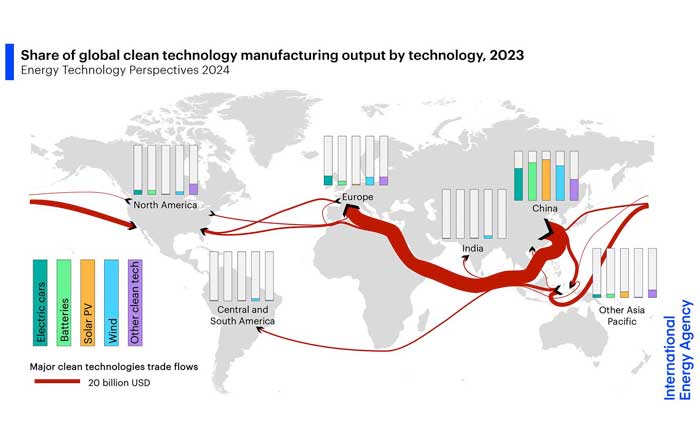

The ongoing strategic competition between the United States and China remains a defining feature of this environment, particularly in sectors such as semiconductors, telecommunications, quantum computing, and artificial intelligence. Export controls on advanced chips, restrictions on certain AI tools, and tighter screening of outbound and inbound investments have affected not only bilateral flows but also the operations of companies in Europe, Japan, South Korea, and Southeast Asia that sit within these global technology supply chains. Businesses that depend on sophisticated hardware or cross-border data flows must now treat technology risk and policy shifts as central elements of their planning.

At the same time, regional flashpoints-from Eastern Europe and the Middle East to the South China Sea and the Red Sea-have demonstrated how quickly shipping routes can be disrupted, insurance costs can spike, and regulatory frameworks can be rewritten. Trade protectionism has re-emerged in various forms, including local content requirements, industrial subsidies, and defensive trade remedies. Regulatory divergence, particularly around data, digital services, and environmental standards, forces companies to operate with multiple compliance regimes in parallel. For readers tracking world developments and global markets, these trends underscore that geopolitical risk is now a structural feature of the trade landscape rather than a temporary anomaly.

Why Geopolitical Risk Management Is Now Strategic, Not Tactical

In earlier eras, geopolitical risk was often treated as a specialised concern handled by government affairs teams or external consultants, consulted when a crisis erupted or when entering a particularly volatile market. In 2026, that approach is no longer viable. The cumulative impact of overlapping crises-pandemics, wars, cyber incidents, energy shocks, and regulatory shifts-has shown that geopolitics can directly affect revenue forecasts, capital expenditure, hiring plans, and product roadmaps. Consequently, leading organizations now integrate geopolitical analysis into their core strategic processes, from market selection and investment decisions to supply chain design and technology adoption.

This strategic shift is evident in the way boardrooms discuss risk. Rather than asking whether a given country is "safe" or "risky," executives increasingly examine how different scenarios could interact: how a change in US policy could affect European regulations, how a regional conflict might intersect with energy transition policies, or how data localisation laws could reshape cloud and AI strategies. The best-prepared companies pair this analysis with robust scenario planning, stress-testing their business models against multiple futures, and aligning their responses with broader economic and market trends.

For the audience of UpBizInfo, which spans founders, executives, and investors across North America, Europe, and Asia-Pacific, this means that geopolitical risk management has become a source of competitive differentiation. Firms that anticipate regulatory changes, diversify exposure, and build credible contingency plans are better positioned to win contracts, secure financing, and maintain customer trust. Those that ignore these dynamics risk sudden loss of market access, stranded assets, reputational damage, or forced restructuring under pressure.

Lessons from Supply Chain Disruptions and Conflict

The conflicts and crises of the early 2020s, including the Russia-Ukraine war and disruptions in key maritime corridors, have provided sobering case studies in how geopolitical shocks cascade through global trade. Energy prices, agricultural exports, critical minerals, and industrial inputs were all affected, forcing companies in Europe, North America, Africa, and Asia to reassess their dependencies. Multinationals that had already invested in alternative sourcing, regional production hubs, and diversified logistics were able to adjust more quickly, while those reliant on single suppliers or routes faced prolonged disruptions and higher costs.

This experience accelerated the move from "just-in-time" efficiency towards a "just-in-case" resilience model. Manufacturers in sectors ranging from automotive and electronics to pharmaceuticals and renewable energy began to map their supply chains more deeply, identifying critical nodes and potential chokepoints. They negotiated multi-supplier contracts, explored nearshoring options in regions such as Eastern Europe, Mexico, and Southeast Asia, and developed contingency shipping routes capable of bypassing conflict zones or politically sensitive straits. For readers focused on global markets and sectoral trends, these changes are reshaping the geography of production and investment.

Logistics leaders such as Maersk, DHL, UPS, and FedEx have responded by integrating geopolitical risk intelligence into their network planning, using real-time data and predictive analytics to reroute cargo, adjust capacity, and communicate proactively with clients. Their actions illustrate a broader principle that UpBizInfo emphasises across its coverage: supply chain resilience is no longer a pure operational concern; it is a board-level issue that intersects with brand positioning, investor expectations, and regulatory scrutiny.

Harnessing AI and Advanced Analytics for Geopolitical Insight

The rise of advanced analytics and artificial intelligence has transformed how companies monitor and interpret geopolitical developments. Instead of relying solely on periodic reports or qualitative assessments, organizations can now deploy AI-powered tools that continuously scan news sources, official statements, legislative databases, financial markets, and social media for early signals of instability or policy change. These tools can identify patterns that human analysts might miss, flagging shifts in sentiment, rhetoric, or regulatory activity that could foreshadow trade restrictions, sanctions, or market closures.

For example, natural language processing models can analyse parliamentary debates, regulatory consultations, and policy papers to infer the likelihood and timing of new rules affecting data flows, crypto assets, or cross-border payments. Machine learning algorithms can correlate political events with movements in currency, bond, and equity markets, helping risk teams understand where vulnerabilities are emerging. For readers interested in AI and its impact on business, exploring how to integrate AI into risk management is becoming an essential strategic question.

Global advisory firms such as McKinsey & Company, Deloitte, and Boston Consulting Group have developed sophisticated geopolitical and macro-risk platforms that combine AI-driven analytics with expert human judgement, offering scenario modelling and decision support for multinational clients. While these tools cannot eliminate uncertainty, they can significantly enhance the speed and precision of responses, allowing companies to adjust trade flows, hedging strategies, and investment plans before disruptions fully materialise. For the UpBizInfo community, the message is clear: AI is not only transforming products and customer experiences; it is also redefining how leaders perceive and manage geopolitical exposure.

Diversification as a Core Risk Mitigation Strategy

Trade diversification has emerged as one of the most effective levers for reducing geopolitical vulnerability. Companies that depend heavily on a single market for revenue, or on a narrow set of countries for critical inputs, are exposed to sudden regulatory, political, or security shocks that can be difficult to absorb. By contrast, firms that cultivate a diversified portfolio of markets, suppliers, and logistics options can re-balance their operations when conditions change, even if this entails higher short-term costs.

In manufacturing, this has translated into a more distributed footprint, with production networks spanning North America, Europe, and Asia, and growing interest in Africa and Latin America as alternative or complementary locations. For the digital economy, diversification involves spreading data storage, cloud services, and digital infrastructure across multiple jurisdictions to comply with local rules and reduce exposure to unilateral restrictions. Companies active in crypto and digital finance have been particularly sensitive to regulatory shifts, often maintaining parallel operations in jurisdictions with supportive frameworks to ensure continuity if one market tightens its rules.

From an investor's perspective, diversification is also a financial imperative. Portfolios that are concentrated in a single region or sector can be hit hard by sanctions, capital controls, or abrupt policy changes, while those that integrate a mix of geographies, asset classes, and themes tied to long-term trends such as decarbonisation or digitalisation are better placed to weather volatility. The UpBizInfo coverage of investment opportunities and global markets increasingly reflects this reality, highlighting how geopolitical diversification aligns with both risk management and growth ambitions.

Strategic Partnerships, Alliances, and Institutional Engagement

In a fragmented global landscape, companies rarely navigate geopolitical challenges alone. Strategic alliances-with local partners, industry peers, and public institutions-can provide critical insight, legitimacy, and flexibility. Collaborating with local firms in target markets helps international businesses understand regulatory nuances, cultural expectations, and informal networks of influence, which can be decisive when regulations are ambiguous or evolving. For founders and executives expanding into new geographies, this type of partnership is often as important as capital or technology.

Engagement with multilateral and national institutions is equally vital. Organizations such as the World Trade Organization, the Organisation for Economic Co-operation and Development, and regional development banks provide analysis, forums for dispute resolution, and guidance on emerging trade rules. National export credit agencies and investment promotion bodies can offer financing, guarantees, and political risk insurance that support expansion into higher-risk markets. By participating actively in these networks, companies gain early visibility into policy shifts and can contribute their perspectives to regulatory design, rather than reacting only after rules are set.

Industry associations, including the International Chamber of Commerce, sector-specific councils, and business federations, play a complementary role by aggregating the concerns of their members and advocating for predictable, rules-based trade environments. For UpBizInfo readers who follow global business and policy developments, understanding these institutional dynamics is crucial, as they often determine whether new regulations become manageable guardrails or severe constraints.

Compliance, Ethics, and the Trust Premium

In 2026, compliance is not just about avoiding fines; it is central to building trust with regulators, customers, employees, and investors. Companies operating across borders must navigate a dense and evolving web of sanctions, export controls, anti-money-laundering rules, data protection laws, and anti-corruption statutes such as the U.S. Foreign Corrupt Practices Act and the UK Bribery Act. Non-compliance can trigger not only financial penalties but also bans on public contracts, restrictions on market access, and lasting reputational damage that affects brand equity and hiring.

Leading firms therefore invest in robust compliance architectures that combine clear governance structures, regular training, rigorous due diligence on partners and suppliers, and integrated monitoring systems that alert management to potential breaches. They increasingly use technology-such as automated screening of transactions, AI-driven anomaly detection, and blockchain-based traceability-to strengthen controls and demonstrate transparency. For financial institutions and fintechs, as well as companies active in banking and capital markets, these capabilities are now foundational, given the scrutiny applied by regulators and the systemic importance of financial stability.

Ethical conduct and strong governance are also becoming competitive differentiators. Investors, including major asset managers and sovereign wealth funds, incorporate environmental, social, and governance criteria into their decisions, rewarding companies that can demonstrate integrity and resilience. For UpBizInfo's audience, which tracks both corporate performance and macroeconomic policy shifts, this convergence of compliance, ethics, and capital allocation reinforces the importance of trustworthiness as a strategic asset rather than a mere regulatory obligation.

Regional Geopolitical Dynamics and Trade Realignment

While global themes such as US-China competition and climate policy shape the overall trade environment, regional dynamics add further layers of complexity. In the Asia-Pacific region, the interplay between China, Japan, South Korea, ASEAN members, India, and partners such as Australia and Singapore continues to redefine supply chains in electronics, automotive, and energy. New trade agreements and security partnerships influence where companies choose to locate production, R&D, and regional headquarters, with implications for employment and job creation across multiple economies.

In Europe, the post-Brexit settlement, the European Union's evolving stance on strategic autonomy, and the implementation of green industrial policies are reshaping trade flows and regulatory expectations for sectors ranging from financial services to clean technologies. In North America, the USMCA framework underpins integrated manufacturing and agriculture, while debates over industrial policy, immigration, and energy transition continue to influence investment decisions. Africa's African Continental Free Trade Area (AfCFTA) offers long-term potential for intra-regional commerce and industrialisation, even as political instability and infrastructure gaps in some countries pose near-term challenges.

Latin America, the Middle East, and South Asia are likewise recalibrating their trade and investment strategies, seeking to balance relationships with major powers while attracting capital for infrastructure, digital transformation, and renewable energy. For readers of UpBizInfo who follow world and regional developments, these shifts create a mosaic in which no single region dominates all dimensions of trade, and diversification becomes not only prudent but necessary.

Cybersecurity, Digital Trade, and the New Front Line of Geopolitics

As trade becomes ever more digital, cybersecurity and data governance have emerged as critical fronts in geopolitical competition. State-sponsored cyber operations, intellectual property theft, ransomware attacks, and supply chain intrusions pose serious risks to companies in sectors such as technology, finance, healthcare, manufacturing, and logistics. The World Economic Forum and national cyber agencies have repeatedly warned that cyber incidents can disrupt critical infrastructure, undermine trust in digital payment systems, and cause cascading failures in global supply chains.

For businesses operating across borders, the challenge is twofold. They must protect their own systems and data against increasingly sophisticated threats, and they must adapt to divergent regulatory approaches to data privacy, localisation, and cross-border transfers. Regulations such as the EU's General Data Protection Regulation and emerging data laws in countries like China, India, and Brazil require careful structuring of cloud architectures, data flows, and vendor relationships. Companies active in technology-driven sectors and digital finance or crypto must therefore integrate cybersecurity and data compliance into their core business models, not as afterthoughts.

To mitigate these risks, leading organizations invest in layered defences, including AI-enhanced threat detection, zero-trust architectures, regular penetration testing, and comprehensive incident response plans. They also scrutinise third-party vendors and partners, recognising that weaknesses in the broader ecosystem can be exploited as entry points. For the UpBizInfo audience, which spans decision-makers in technology, banking, and global trade, cyber resilience is now inseparable from geopolitical resilience.

ESG, Sustainability, and the Politics of Trade

Environmental, Social, and Governance considerations have moved from the margins of corporate reporting to the heart of trade and investment strategy. Governments are increasingly linking market access, subsidies, and public procurement to ESG performance, while consumers and civil society organisations place pressure on brands to demonstrate responsible behaviour across their value chains. Climate policy, in particular, has become a major driver of trade realignment, as seen in mechanisms such as the European Union's Carbon Border Adjustment Mechanism, which affects exporters in energy-intensive sectors.

For companies active in manufacturing, agriculture, energy, and logistics, this means that sustainability is not only a moral imperative but also a geopolitical one. Aligning operations with climate goals, human rights standards, and anti-corruption norms can reduce exposure to trade restrictions, boycotts, and litigation. Conversely, failure to address ESG risks-such as forced labour allegations, environmental degradation, or opaque governance-can lead to import bans, investor divestment, and lasting damage to reputation. To stay ahead of these trends, many organizations are integrating sustainable business practices into procurement, product design, and capital allocation.

For UpBizInfo readers, particularly those focused on long-term investment themes, the intersection of ESG and geopolitics is a critical area of opportunity and risk. Companies that can credibly demonstrate low-carbon, socially responsible, and well-governed operations are more likely to secure licences, attract talent, and enjoy stable relationships with host governments and communities.

Corporate Diplomacy and Strategic Engagement

In a world where corporations often rival states in economic scale and influence, corporate diplomacy has become a distinct discipline. It involves systematic engagement with governments, regulators, local communities, NGOs, and multilateral institutions to build long-term relationships, manage expectations, and align business objectives with public policy priorities. For firms operating in sensitive sectors such as energy, mining, technology, defence, and infrastructure, this engagement can be decisive in obtaining permits, resolving disputes, and maintaining continuity during political transitions.

Corporate diplomacy requires cultural intelligence, patience, and a deep understanding of local political economies. It also requires coherent internal coordination, so that messages delivered by executives, government affairs teams, and local managers are consistent and credible. When executed well, corporate diplomacy can help companies anticipate shifts in policy, contribute constructively to regulatory design, and position themselves as trusted partners in national development agendas. For UpBizInfo's global readership, which includes founders and leaders expanding into new markets, this discipline is increasingly viewed as a necessary complement to financial and operational expertise.

From Risk to Advantage: A Strategic Mindset for 2026 and Beyond

The defining characteristic of geopolitical risk in 2026 is its persistence. Companies cannot wait for a return to a simpler, more predictable era of globalisation; instead, they must develop the capabilities to operate in a world where political, economic, technological, and social forces interact in complex and often unpredictable ways. For the community that turns to UpBizInfo for insight into business, technology, markets, and employment, this reality underscores the importance of experience, expertise, authoritativeness, and trustworthiness in corporate leadership.

Organizations that treat geopolitical risk management as a strategic function-supported by AI-driven analytics, diversified supply chains, robust compliance, ESG integration, and thoughtful corporate diplomacy-can do more than merely survive crises. They can identify new markets opened by shifting alliances, innovate products and services that address emerging regulatory or security needs, and build reputations as reliable partners in an uncertain world. Those that cling to narrow, short-term perspectives will find themselves increasingly exposed, reactive, and constrained.

In this context, the role of informed, independent analysis becomes even more important. By connecting developments in AI, banking, crypto, employment, global markets, sustainability, and technology, UpBizInfo aims to equip its audience with the perspective needed to navigate this complex landscape. Geopolitical volatility will remain a defining feature of global trade, but with the right frameworks and capabilities, it can be transformed from a source of constant threat into a catalyst for resilience, innovation, and long-term strategic advantage.