The 10 Most In-Demand Tech Jobs in China in 2026: Strategic Roles Shaping a Global Powerhouse

China enters 2026 at a decisive moment in its technological evolution. The country is no longer content to be the world's factory or a fast follower in digital platforms; instead, it is positioning itself as a global leader in artificial intelligence, semiconductors, clean energy, biotech, robotics, and digital infrastructure. For the readership of UpBizInfo.com, which prioritizes Experience, Expertise, Authoritativeness, and Trustworthiness, understanding where China's technology labor market is heading has become essential to making informed decisions about careers, investments, partnerships, and long-term strategy.

From Beijing and Shanghai to Shenzhen, Chengdu, and the Greater Bay Area, competition for world-class talent is intensifying, driven by industrial policy, national security concerns, and the race to capture value in emerging technologies. The most sought-after roles are not generic software positions; they sit at the intersection of deep technical specialization, domain expertise, and strategic national priorities. They are difficult to automate, hard to offshore, and central to China's ambitions in areas such as AI sovereignty, semiconductor independence, climate resilience, and life sciences innovation.

This article offers a comprehensive, third-person analysis of the ten most in-demand technology roles in China in 2026, explaining the structural forces driving demand, the skills and experience that differentiate top performers, and the implications for global businesses and professionals. Throughout the discussion, readers are invited to explore related coverage on UpBizInfo.com, including dedicated pages for AI, technology, investment, economy, and business, which together provide a broader context for these trends.

China's Tech Ecosystem in 2026: Policy, Pressure, and Opportunity

China's technology ecosystem in 2026 is defined by three converging forces: domestic policy acceleration, external geopolitical pressure, and rapid commercialization of frontier technologies. The state continues to anchor its strategy in the 14th and forthcoming 15th Five-Year Plans, the evolving "dual circulation" model, and targeted initiatives around AI, advanced manufacturing, and green development. These frameworks prioritize indigenous innovation, resilience in strategic supply chains, and the development of national champions across critical technologies.

At the same time, export controls on advanced chips, restrictions on certain cross-border investments, and heightened scrutiny of data flows have compelled Chinese firms to invest more aggressively in homegrown capabilities. This pressure has pushed companies and research institutes to intensify recruitment for specialists in semiconductors, quantum computing, cybersecurity, and AI infrastructure. International organizations such as the World Economic Forum and the OECD continue to highlight China's outsized contribution to global R&D spending and patent generation, even as they note structural challenges such as demographic aging and productivity headwinds.

Labor market dynamics are equally complex. Youth unemployment remains a concern, yet at the same time there are acute shortages of senior engineers, applied scientists, and cross-disciplinary experts. China's efforts to attract foreign professionals and overseas returnees through streamlined visas, talent zones, and generous incentive packages are reshaping the talent landscape, particularly in cities like Shenzhen, Shanghai, and Hefei. For readers tracking these employment shifts, UpBizInfo.com offers complementary perspectives on employment and jobs, connecting macro trends with on-the-ground realities.

Against this backdrop, ten categories of technology roles stand out as especially consequential for 2026. They span AI, hardware, climate tech, biotech, cybersecurity, infrastructure, and urban intelligence, and together they reveal how China intends to compete in the next phase of global innovation.

1. Generative AI and Large Language Model Architects

Generative AI has moved from experimental deployments to core infrastructure in China's digital economy. Large language models and multimodal systems now underpin customer service, enterprise automation, content generation, drug discovery, and financial analytics. Architects who design, train, and optimize these systems are among the most coveted professionals in the country.

In 2026, Baidu, Tencent, Alibaba, ByteDance, and emerging players such as Zhipu AI and MiniMax continue to race to build competitive foundation models tailored to Chinese language, culture, and regulatory norms. Their architects must master transformer architectures, distributed training at scale, retrieval-augmented generation, model alignment, and safety mechanisms that satisfy both commercial requirements and state content standards. They must also integrate models into vertical applications in healthcare, law, manufacturing, and finance, often collaborating with domain experts to build highly specialized copilots and decision-support tools.

These roles increasingly demand familiarity with global best practices in AI safety and governance, as developed by organizations such as OpenAI, Anthropic, and research communities documented by the Allen Institute for AI. Yet localization is critical; architects must design systems that respect China's data security and algorithmic regulation frameworks while still delivering competitive performance. Compensation for senior architects routinely includes high six-figure or seven-figure CNY packages, equity, and, in some cases, revenue-sharing tied to model commercialization. For readers seeking a deeper strategic lens on AI's business impact, UpBizInfo.com maintains an evolving analysis hub at upbizinfo.com/ai.html.

2. Quantum Computing and Post-Quantum Cryptography Engineers

Quantum technology has become a pillar of China's long-term national security and economic strategy. Engineers specializing in quantum computation, quantum communication, and post-quantum cryptography are at the forefront of this effort, working within a tightly integrated ecosystem of national laboratories, universities, and corporate research centers.

Institutions such as the National Laboratory for Quantum Information Science in Hefei, Alibaba Quantum Laboratory, Origin Quantum, and Huawei's quantum research units are pushing forward in superconducting qubits, photonic systems, and quantum key distribution networks. Engineers in these environments must combine deep knowledge of quantum physics with advanced algorithm design, error correction, cryogenic engineering, and secure protocol implementation. Their work has direct implications for secure communications, optimization problems in logistics and finance, and future-proofing encryption against quantum attacks.

Globally, organizations like IBM Quantum and Google Quantum AI set benchmarks for hardware and software maturity, and Chinese teams are under pressure to match or surpass these capabilities while building sovereign infrastructure. The scarcity of experienced quantum engineers worldwide means that China competes directly with North American, European, and Asian employers, often offering research grants, housing allowances, and fast-tracked residency to attract top talent. For investors and policymakers assessing the macroeconomic implications of quantum investment, the broader context is explored on UpBizInfo.com's economy and investment pages.

3. Advanced Semiconductor and Nanofabrication Engineers

Semiconductors remain the most visible arena where technology, geopolitics, and industrial policy intersect. In 2026, China continues to pour capital into fabs, design houses, and equipment suppliers in an attempt to narrow the gap at leading-edge nodes and secure control over key components such as memory, analog chips, and power semiconductors.

Engineers with expertise in process integration, nanofabrication, lithography, etching, deposition, and yield optimization are in chronically short supply. SMIC, Yangtze Memory Technologies, and a growing constellation of state-backed foundries and design startups are recruiting aggressively, as are research institutes aligned with the Chinese Academy of Sciences. These organizations seek professionals capable of working with or around export-restricted equipment, developing novel process flows, and co-designing chips with software to maximize performance on AI and high-performance computing workloads.

In parallel, China is investing in alternative architectures and open standards, including RISC-V-based processors and domestic GPU solutions. Engineers who understand both the hardware and the software toolchain, including EDA flows and compiler optimization, are particularly valuable. International benchmarks from groups like TSMC and ASML underscore the technical hurdles involved, but they also reinforce the strategic importance of every incremental advance within China's ecosystem. For readers following how these developments affect capital flows and corporate strategy, UpBizInfo.com provides ongoing coverage at upbizinfo.com/technology.html and upbizinfo.com/business.html.

4. Autonomous Systems and Robotics Engineers

Robotics and autonomous systems have become central to China's productivity agenda, particularly as the working-age population shrinks and wage pressures increase in manufacturing and logistics. Engineers who can design, integrate, and deploy robotic systems at industrial scale are shaping the next generation of "smart factories," warehouses, and urban services.

Companies such as DJI, UBTECH Robotics, Horizon Robotics, Pony.ai, WeRide, and AutoX exemplify the breadth of this sector, spanning consumer drones, humanoid robots, industrial arms, and autonomous vehicles. Their engineers must be proficient in robot operating systems, real-time control, computer vision, sensor fusion, SLAM, reinforcement learning, and safety-critical software engineering. They work closely with manufacturing partners and city authorities to move prototypes beyond pilots and into reliable, regulated, revenue-generating deployment.

Regional clusters in Shenzhen, Guangzhou, Suzhou, and Chengdu host dense networks of component suppliers, integrators, and software startups, making them magnets for robotics talent. Global research from institutions such as the Massachusetts Institute of Technology and the Fraunhofer Society continues to influence best practices, but China's scale and speed of implementation give its engineers unique experience in operating at industrial volumes. Readers interested in how robotics intersects with global markets and supply chains can explore additional reporting at upbizinfo.com/world.html and upbizinfo.com/markets.html.

5. Clean Energy, Grid Intelligence, and Climate Tech Engineers

China's pledge to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 has catalyzed one of the world's largest clean-energy build-outs. Engineers in climate technology, grid intelligence, and energy storage are now essential to meeting both domestic policy targets and global climate commitments.

Organizations such as CATL, Sungrow Power Supply, LONGi Green Energy, and a wave of hydrogen, carbon capture, and energy-management startups are recruiting specialists in electrochemistry, battery management systems, power electronics, smart grid control, and AI-driven forecasting. These professionals must design systems that integrate solar, wind, hydro, and storage into a resilient grid, while also enabling electrification of transport and industry.

The intersection of digital and physical infrastructure is particularly important. Engineers who can combine domain expertise in energy systems with data science, IoT connectivity, and edge computing architectures are able to deliver significant efficiency gains. International initiatives tracked by the International Energy Agency and the International Renewable Energy Agency highlight how China's deployment scale influences global technology costs and standards. For readers seeking to connect sustainability, markets, and strategy, UpBizInfo.com offers additional insight at upbizinfo.com/sustainable.html.

6. Synthetic Biologists and Bioinformatics Engineers

Biotechnology has become another strategic pillar in China's pursuit of health security, agricultural resilience, and high-value manufacturing. Synthetic biologists and bioinformatics engineers sit at the heart of this transformation, designing biological systems and analyzing massive genomic datasets to unlock new therapies, crops, and materials.

Institutions such as Beijing Genomics Institute (BGI), WuXi AppTec, and numerous state-supported innovation zones are scaling up genomics, cell therapy, and bio-manufacturing capabilities. Professionals in this space require deep fluency in molecular biology, CRISPR gene editing, metabolic pathway engineering, and high-throughput screening, combined with strong computational skills in Python, R, and machine learning frameworks for genomic data.

Their work is increasingly intertwined with AI, as generative models and protein-folding algorithms accelerate target discovery and design. Global scientific advances documented by journals hosted on platforms like Nature and Science are rapidly translated into Chinese research projects and commercial pipelines. Regulatory and ethical considerations are becoming more complex, requiring engineers to navigate evolving biosafety frameworks and international collaboration norms. For founders and investors evaluating biotech opportunities in China and abroad, UpBizInfo.com's founders and investment sections provide complementary analysis.

7. Cybersecurity, Data Protection, and Zero-Trust Architects

As China's economy digitizes across banking, manufacturing, transportation, and public services, cybersecurity has become a board-level priority and a core regulatory focus. Architects who can design zero-trust architectures, secure cloud environments, and robust data-protection frameworks are in sustained demand across both the public and private sectors.

Financial institutions, telecom operators, cloud providers, and critical infrastructure operators must comply with an expanding suite of cybersecurity and data-protection regulations, including the Cybersecurity Law, the Data Security Law, and the Personal Information Protection Law (PIPL). Cybersecurity professionals are expected to master threat modeling, incident response, secure software development, AI-driven anomaly detection, and privacy-preserving analytics such as federated learning and secure enclaves.

Global best practices from organizations like the National Institute of Standards and Technology and the Cybersecurity and Infrastructure Security Agency inform many technical frameworks, yet Chinese organizations must adapt them to local compliance requirements and censorship regimes. The financial sector, in particular, is investing heavily in talent that can secure digital banking, mobile payments, and cross-border transaction systems. For readers interested in how cybersecurity intersects with finance and regulation, UpBizInfo.com's banking and news pages offer ongoing coverage.

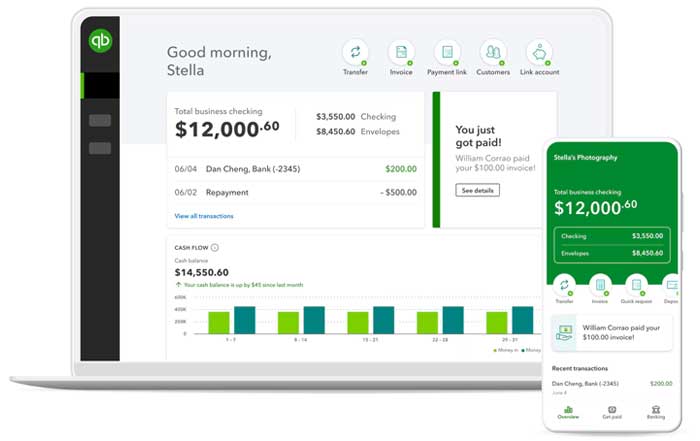

8. Data Scientists and Advanced Analytics Leaders

Data remains the connective tissue of China's digital economy, and data scientists continue to occupy a pivotal role in turning information into competitive advantage. However, expectations for this role have evolved significantly by 2026. Organizations now demand professionals who not only build predictive models but also design end-to-end data products, embed analytics into operational workflows, and ensure compliance with data-governance rules.

E-commerce leaders such as Alibaba, JD.com, and Pinduoduo, platform companies like Meituan and Didi, and a wide range of fintech and industrial firms rely on advanced analytics to optimize logistics, pricing, personalization, fraud detection, and risk management. Data scientists increasingly work with real-time data streams, graph analytics, causal inference, and reinforcement learning to support decision-making in milliseconds rather than days.

Internationally recognized guidelines from bodies such as the OECD's AI policy observatory and the European Commission on trustworthy AI influence how organizations think about fairness, transparency, and accountability in algorithmic systems. In China, data scientists must adapt these principles to domestic regulatory frameworks and public expectations. Their ability to communicate insights to non-technical executives and align analytics with business KPIs is often as important as their coding or modeling skills. Readers interested in how these roles shape labor markets and organizational structures can explore UpBizInfo.com's coverage at upbizinfo.com/employment.html.

9. Cloud, Edge Infrastructure, SRE, and DevOps Engineers

Behind every visible digital service in China-whether social commerce, streaming, industrial IoT, or smart mobility-stands a vast, complex infrastructure layer. Cloud, edge, site reliability engineering (SRE), and DevOps roles are critical to designing, operating, and scaling that infrastructure under demanding conditions.

Alibaba Cloud, Tencent Cloud, Huawei Cloud, and regional providers operate massive data-center networks that must meet stringent performance, security, and data-localization requirements. Engineers in these organizations are responsible for building and maintaining containerized environments, microservices architectures, CI/CD pipelines, observability stacks, and hybrid cloud solutions that connect on-premise, public cloud, and edge nodes. They must ensure reliability during extreme traffic peaks, such as national shopping festivals or major entertainment events, where service interruptions can have significant financial and reputational consequences.

Edge computing is expanding rapidly in manufacturing parks, logistics hubs, and retail environments, enabling low-latency analytics and control. Engineers who can blend networking, distributed systems, and hardware awareness are particularly sought after. Global cloud practices from firms like Amazon Web Services and Microsoft Azure inform architectural patterns, but Chinese engineers must adapt them to local regulatory and ecosystem constraints. For readers examining how infrastructure choices influence competition and market structure, UpBizInfo.com offers additional perspectives at upbizinfo.com/technology.html and upbizinfo.com/markets.html.

10. Spatial Computing, Digital Twin, and Smart City Engineers

China's urbanization and infrastructure modernization have given rise to one of the world's most ambitious smart-city and digital-twin programs. Engineers specializing in spatial computing, urban simulation, and integrated sensor networks are playing a central role in reshaping how cities are planned, built, and managed.

Municipal governments in Shanghai, Shenzhen, Hangzhou, and other major metros are investing in platforms that integrate IoT devices, high-definition mapping, traffic management, environmental monitoring, and public-service delivery into unified command centers. Spatial computing engineers design the underlying data models, 3D visualizations, and analytics engines that allow city officials to simulate policy changes, respond to emergencies, and optimize resource allocation.

Their work often overlaps with AR/VR interfaces, construction technology, and industrial digital twins used in ports, factories, and energy facilities. International organizations such as UN-Habitat and the World Bank highlight China's smart-city experiments as influential case studies, even as they raise questions about privacy, governance, and inclusivity. Engineers in this field must balance technical ambition with social responsibility, designing systems that are resilient, interoperable, and aligned with long-term urban development goals. For readers tracking how these initiatives intersect with global business and policy, UpBizInfo.com offers cross-regional analysis at upbizinfo.com/world.html.

Cross-Cutting Patterns in China's 2026 Tech Talent Demand

Although these ten roles differ in domain and day-to-day responsibilities, several common themes define the profiles most in demand. First, domain convergence is now the norm: the most valuable professionals combine deep technical expertise with sector-specific knowledge, such as AI plus finance, robotics plus manufacturing, or bioinformatics plus clinical science. Second, cross-disciplinary fluency is increasingly critical, as complex projects require collaboration across hardware, software, data, and policy boundaries.

Third, localization and regulatory literacy are decisive advantages. Professionals who understand China's data, cybersecurity, and industry-specific regulations, and who can design compliant yet competitive systems, are more likely to advance into leadership roles. Fourth, demonstrable output-patents, peer-reviewed publications, open-source contributions, or large-scale deployments-serves as a key signal of expertise in a market where credentials alone are no longer sufficient.

Finally, a mindset of continuous learning is indispensable. The pace of change in AI, quantum, biotech, and climate tech demands ongoing upskilling through advanced degrees, online courses, industry conferences, and participation in global communities such as those hosted by the Association for Computing Machinery or the Institute of Electrical and Electronics Engineers. UpBizInfo.com, through its coverage of technology, business, and news, aims to support this lifelong learning journey with curated, trustworthy insights.

Strategic Implications for Global Professionals and Organizations

For professionals worldwide-from the United States, Europe, and the United Kingdom to Singapore, Japan, South Korea, and beyond-China's 2026 technology labor market represents both an opportunity and a strategic consideration. Those who bring rare expertise in AI, semiconductors, quantum, or biotechnology may find compelling roles in Chinese firms, joint ventures, or R&D centers, though they must weigh regulatory, cultural, and geopolitical factors carefully. Fluency in Mandarin, familiarity with local business practices, and a nuanced understanding of regional policy frameworks significantly enhance the ability to operate effectively in this environment.

For organizations, whether domestic or multinational, the competition for these ten categories of talent will shape strategic choices in investment, location, and partnership. Companies that wish to access China's innovation capacity may choose to establish or expand R&D operations in key hubs, collaborate with local universities and institutes, or form joint ventures with established players. Others may focus on adjacent markets in Asia, Europe, or North America while still monitoring China's rapid progress for competitive benchmarking.

In all cases, a clear understanding of where China is concentrating its human capital-AI infrastructure, quantum research, semiconductor manufacturing, climate technology, biotechnology, cybersecurity, data science, cloud and edge infrastructure, and smart-city systems-provides valuable insight into future global competitive dynamics. For readers of UpBizInfo.com, this alignment between talent, technology, and strategy is central to evaluating opportunities in investment, markets, and business, not only in China but across North America, Europe, Asia, Africa, and South America.

As 2026 unfolds, the roles profiled here will continue to evolve, but their strategic significance is unlikely to diminish. They are the levers through which China seeks to shape the next era of global technology, and they will remain essential reference points for executives, founders, investors, and professionals who rely on UpBizInfo.com as a trusted guide to the world's most important business and technology trends.