Climate Change and the New Global Economy: How Business, Finance, and Technology Are Being Rebuilt

As the year unfolds, climate change has fully transitioned from a distant scientific warning to a defining economic force that shapes strategy in boardrooms, cabinet meetings, and investment committees across the world. For decision-makers who turn to upbizinfo.com to understand the intersection of markets, technology, and policy, climate risk is no longer a specialist topic; it is a central lens through which global growth, competitiveness, and stability must be evaluated. The business community is recognizing that resilience and sustainability are now core determinants of long-term value creation.

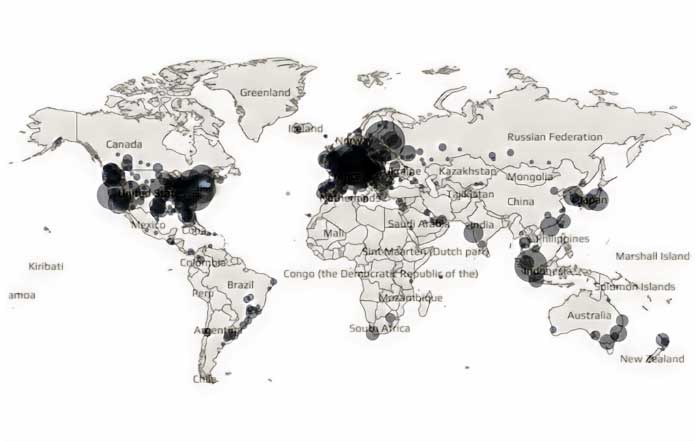

Economic institutions, from the World Bank to the International Monetary Fund (IMF), continue to warn that unchecked climate disruption threatens to erode decades of development gains, particularly in vulnerable regions across Africa, Asia, and South America. Learn more about how climate risk is reshaping development priorities on the World Bank's climate overview at worldbank.org. At the same time, leading economies in North America, Europe, and Asia-Pacific are accelerating their transition toward low-carbon growth models, betting that leadership in clean technology, green finance, and resilient infrastructure will define the next wave of global competitiveness. For upbizinfo.com, which serves a readership focused on AI, banking, business, crypto, employment, investment, and technology, this shift is not an abstract policy debate; it is the new operating reality for entrepreneurs, executives, and investors.

Climate Risk as a Core Economic Variable

The defining characteristic of the climate economy in 2026 is that risk has become both more visible and more quantifiable. Extreme heat, droughts, floods, and wildfires have created a new pattern of disruption that affects everything from agricultural output and energy demand to insurance pricing and sovereign risk. The Intergovernmental Panel on Climate Change (IPCC) continues to refine its projections, but the economic narrative is already clear: climate volatility is now a structural feature of the global system rather than a cyclical anomaly. For a deeper look at scientific assessments, readers can explore the IPCC's reports at ipcc.ch.

In practice, this means that climate variables are now embedded in macroeconomic forecasting, credit analysis, and corporate planning. Central banks, including the European Central Bank and the Bank of England, have expanded climate stress testing to assess how banks, insurers, and asset managers would respond under different warming scenarios. These exercises are not merely theoretical; they influence capital requirements, supervisory expectations, and the cost of capital for carbon-intensive sectors. On upbizinfo.com/economy.html, this integration of environmental risk into economic policy is a recurring theme, as fiscal and monetary authorities in the United States, the United Kingdom, the Eurozone, and across Asia and Africa recalibrate their strategies for a warming world.

At the firm level, climate exposure is now considered a material financial risk. The Task Force on Climate-related Financial Disclosures (TCFD) and the emerging standards of the International Sustainability Standards Board (ISSB) have turned what was once voluntary sustainability communication into a quasi-mandatory discipline in major markets. Learn more about evolving global disclosure frameworks via the ISSB's resources at ifrs.org. For businesses that appear on upbizinfo.com/business.html, this means climate governance is no longer relegated to CSR departments; it sits at the center of board oversight, risk management, and strategic capital allocation.

Supply Chains, Trade, and the Geography of Vulnerability

Globalization has made the world's production systems highly efficient but also acutely sensitive to localized climate shocks. Floods in Germany, typhoons in Southeast Asia, and prolonged droughts in Latin America have repeatedly exposed the fragility of just-in-time supply chains. When manufacturing hubs in Asia or logistics corridors in Europe and North America are disrupted, the impact cascades through sectors as diverse as automotive, electronics, food processing, and pharmaceuticals.

The operational challenges at the Panama Canal and Suez Canal in recent years, driven in part by drought conditions and climate-linked disruptions, have highlighted how dependent global trade is on a handful of critical chokepoints. The International Maritime Organization (IMO) has responded with decarbonization regulations for shipping, and leading logistics companies are investing in alternative fuels and route diversification. Learn more about maritime decarbonization at imo.org. For executives tracking these dynamics on upbizinfo.com/markets.html, the implication is clear: climate resilience in logistics is now an element of competitive strategy, not just an operational detail.

Corporations with complex global supply networks are increasingly relying on climate analytics, satellite data, and AI-driven forecasting to identify vulnerabilities and design redundancy. This is especially relevant for companies sourcing raw materials from climate-exposed regions in Africa, South America, and South Asia. The shift toward nearshoring and friend-shoring, particularly in Europe and North America, is frequently justified not only by geopolitical considerations but also by climate risk management. As upbizinfo.com/world.html explores, this reconfiguration of supply chains is reshaping trade flows among the United States, the European Union, China, and emerging economies in Southeast Asia and Africa.

Energy Transition, Markets, and the Redefinition of Power

The energy transition remains the central axis around which the climate economy revolves. By 2026, renewable energy investment has continued to outpace fossil fuel spending, with solar and wind establishing themselves as the cheapest new sources of electricity in most major markets, including the United States, China, India, the European Union, and Australia. The International Energy Agency (IEA) has repeatedly underscored this shift, noting that clean energy investment is now the primary driver of growth in global energy markets. Learn more about the latest trends in the IEA's World Energy Outlook at iea.org.

For hydrocarbon-exporting economies in the Middle East, Africa, and parts of South America, this transition presents a strategic dilemma: how to leverage existing resources while preparing for a world in which oil and gas demand plateaus and then declines. Sovereign wealth funds in countries such as Norway, the United Arab Emirates, and Saudi Arabia are diversifying into renewables, hydrogen, and climate technology, seeking to remain central players in the evolving energy landscape. On upbizinfo.com/investment.html, the repositioning of capital away from carbon-intensive assets and toward green infrastructure is tracked as one of the defining trends in global finance.

In parallel, the geopolitical importance of critical minerals-lithium, cobalt, nickel, and rare earth elements-has increased sharply. These resources underpin battery manufacturing, electric vehicles, and grid-scale storage, placing countries such as Australia, Chile, the Democratic Republic of Congo, and Indonesia at the heart of new strategic supply chains. The International Renewable Energy Agency (IRENA) has highlighted how diversifying and securing mineral supply is essential for a just and resilient energy transition. Readers can explore IRENA's analysis at irena.org. For European, North American, and Asian policymakers, the challenge is to balance rapid scaling of clean technologies with robust environmental and social safeguards in mining and processing.

Finance, Banking, and the Architecture of Green Capital

The financial system has moved from viewing climate as an externality to treating it as a core component of prudential regulation, portfolio strategy, and product innovation. Banks, asset managers, and insurers now operate under growing pressure from regulators, shareholders, and clients to align their activities with net-zero pathways. The Network for Greening the Financial System (NGFS), a coalition of central banks and supervisors, has become a central forum for integrating climate risk into financial oversight. Learn more about NGFS guidance at ngfs.net.

In practical terms, this transformation is reshaping banking models worldwide. Lenders in the United States, Europe, the United Kingdom, and increasingly in Asia-Pacific are embedding climate criteria into credit assessments, offering preferential terms for energy-efficient real estate, clean infrastructure, and sustainable industry upgrades. At the same time, carbon-intensive borrowers face tighter conditions and, in some cases, reduced access to capital. Analysts at upbizinfo.com/banking.html examine how green lending, sustainability-linked loans, and transition finance products are becoming standard features of modern banking, influencing everything from small business financing in Canada and Australia to large-scale project finance in India and Brazil.

Capital markets are also evolving. Green bonds, sustainability-linked bonds, and climate-aligned indices have moved into the mainstream, with major exchanges in New York, London, Frankfurt, Singapore, and Hong Kong listing an expanding universe of sustainable instruments. The Climate Bonds Initiative tracks this market's growth and provides taxonomies that help investors distinguish credible green assets from marketing claims, an increasingly important function as regulators in Europe and North America intensify scrutiny of greenwashing. Learn more about these standards at climatebonds.net. For audiences engaging with upbizinfo.com/crypto.html, the convergence of blockchain and sustainability-particularly in transparent carbon credit registries and renewable energy certificates-illustrates how digital innovation can support trustworthy climate finance.

Technology, AI, and the Climate Innovation Frontier

Technological innovation continues to be the most dynamic pillar of the global climate response. Artificial intelligence, advanced analytics, and automation are now deeply integrated into efforts to decarbonize industry, optimize energy systems, and monitor environmental change in real time. Organizations such as Google DeepMind, Microsoft, and IBM are deploying AI to improve grid stability, forecast renewable output, and enhance climate modeling, while startups across Europe, North America, and Asia are building platforms for carbon accounting, climate risk modeling, and precision agriculture.

For readers of upbizinfo.com/ai.html, the role of AI in climate strategy is particularly relevant. Machine learning models are helping utilities in the United States and Europe balance intermittent wind and solar generation, while in countries like India, Brazil, and South Africa, AI-driven irrigation and crop management tools are helping farmers adapt to erratic weather patterns. The World Economic Forum (WEF) has identified AI-enabled climate solutions as a critical lever for achieving net-zero goals, emphasizing their potential across sectors from transport to manufacturing. Learn more about these applications at weforum.org.

Yet the digital infrastructure that enables these tools also carries an environmental cost. Data centers powering AI and cloud services consume significant amounts of electricity, often in markets where fossil fuels still dominate generation. In response, technology giants in the United States, Europe, and Asia-Pacific are investing aggressively in renewable-powered data centers and advanced cooling systems, as well as signing long-term power purchase agreements to accelerate grid decarbonization. On upbizinfo.com/technology.html, this dual narrative-technology as both a solution and a source of emissions-underscores why digital transformation and sustainability strategies must be developed in tandem.

Employment, Skills, and the Climate Workforce Transition

The global labor market is undergoing a structural shift as climate imperatives reshape industries and occupations. While jobs in coal, oil, and gas extraction are declining in many regions, new employment opportunities are emerging in renewable energy, grid modernization, energy-efficient construction, climate-smart agriculture, and environmental services. The International Labour Organization (ILO) has estimated that the green transition could generate millions of net new jobs globally, provided that education and training systems are aligned with emerging skill demands. Learn more about green jobs and just transition strategies at ilo.org.

For economies in North America, Europe, and advanced Asian markets such as Japan, South Korea, and Singapore, the primary challenge is reskilling and upskilling existing workers to meet demand in clean technology, sustainable finance, and advanced manufacturing. In emerging markets across Africa, South Asia, and Latin America, the focus is on creating climate-resilient livelihoods that blend traditional sectors such as agriculture with new opportunities in solar installation, ecosystem restoration, and circular economy enterprises. Platforms like upbizinfo.com/employment.html and upbizinfo.com/jobs.html track how these shifts are playing out across industries and geographies, highlighting the growing importance of climate literacy as a core competency for professionals in banking, consulting, technology, and beyond.

Climate migration adds another layer of complexity to labor market dynamics. Rising sea levels, intensifying heat, and water scarcity are driving population movements within and across borders, with implications for workforce availability in sectors such as construction, agriculture, logistics, and care services. The United Nations High Commissioner for Refugees (UNHCR) has warned that without robust adaptation and development strategies, climate displacement could become a major source of social and economic instability. Learn more about climate displacement at unhcr.org. For businesses operating in the United States, Canada, Europe, and Asia-Pacific, incorporating climate-driven demographic shifts into workforce planning is now part of long-term human capital strategy.

Corporate Strategy, Governance, and the New Definition of Value

Corporate strategy in 2026 is being rewritten around climate alignment and resilience. Leading companies across sectors-from technology and consumer goods to industrial manufacturing and financial services-now recognize that environmental performance is closely linked to brand equity, regulatory risk, and access to capital. Unilever, Microsoft, Apple, and Nestlé, among others, have committed to science-based emissions targets and are integrating climate considerations into product design, procurement, and logistics. The Science Based Targets initiative (SBTi) has become a central reference point for credible corporate climate commitments. Readers can learn more about its methodologies at sciencebasedtargets.org.

For the global business community that engages with upbizinfo.com/sustainable.html, the rise of circular economy models is particularly significant. Companies in Europe, North America, and Asia are redesigning products to be repairable, reusable, and recyclable, reducing material intensity and waste while opening new revenue streams in remanufacturing and services. This shift is evident in sectors such as fashion, electronics, and construction, where regulatory pressure from the European Union and growing consumer expectations in markets like the United States, Canada, and Australia are converging.

Corporate governance frameworks are also evolving. Boards are increasingly expected to possess climate expertise, and executive compensation is being tied to sustainability metrics in leading firms across the United Kingdom, Germany, France, and the Nordic countries. The Global Reporting Initiative (GRI) and other sustainability reporting frameworks provide guidance on how to measure and disclose environmental performance in a way that investors, regulators, and consumers can trust. Learn more about GRI standards at globalreporting.org. For founders and leaders featured on upbizinfo.com/founders.html, the message is clear: long-term corporate success increasingly depends on credible, transparent, and data-driven climate governance.

Regional Pathways: Converging Goals, Divergent Capacities

While climate change is a global phenomenon, responses are shaped by regional capabilities, political priorities, and development stages. In Europe, the European Green Deal and initiatives such as the EU Carbon Border Adjustment Mechanism (CBAM) are accelerating decarbonization and influencing global trade patterns by linking market access to carbon performance. Learn more about the Green Deal at ec.europa.eu. The United Kingdom, Germany, France, the Netherlands, and the Nordic countries continue to set ambitious climate targets, leveraging their technological and financial strength to position themselves as leaders in green innovation.

In North America, the United States and Canada are using large-scale public investment packages to stimulate domestic clean manufacturing, battery production, and renewable energy deployment. These policies are reshaping industrial geography, with new green industrial clusters emerging in regions historically dependent on fossil fuels. Australia and New Zealand, similarly, are expanding their roles as exporters of clean energy and critical minerals to Asian and European markets.

Asia presents a more heterogeneous picture. China remains both the world's largest emitter and the largest investor in renewable energy and electric vehicles, while Japan and South Korea are advancing hydrogen and advanced materials technologies. Southeast Asian economies such as Singapore, Malaysia, and Thailand are positioning themselves as regional hubs for green finance, manufacturing, and logistics. Learn more about Asia's transition pathways via the Asian Development Bank at adb.org. Across Africa and South America, the challenge is to harness vast renewable resources and biodiversity assets in a way that promotes inclusive growth, climate resilience, and debt sustainability.

On upbizinfo.com/world.html, these regional narratives are examined through the lens of global interdependence: how Europe's regulatory choices affect exporters in Asia and Africa, how North America's industrial policy reshapes supply chains, and how climate finance flows from advanced economies can support adaptation and mitigation in vulnerable regions.

The Role of Media, Communication, and Trusted Platforms

In an environment where climate information influences investment decisions, consumer behavior, and public policy, the role of trusted, independent analysis has become critical. Businesses and investors require not only raw data but also contextual interpretation that connects climate science, regulation, technology, and markets in a coherent narrative. Platforms like upbizinfo.com occupy a pivotal niche by translating complex developments in AI, banking, crypto, employment, markets, and technology into actionable insights for a globally distributed audience spanning the United States, Europe, Asia, Africa, and the Americas.

Climate communication is no longer a matter of advocacy alone; it is a component of risk management and strategic planning. The United Nations Environment Programme (UNEP) and the United Nations Framework Convention on Climate Change (UNFCCC) provide high-level policy and scientific guidance, available at unep.org and unfccc.int, yet businesses often rely on specialized media and analytical platforms to understand what these developments mean for their specific sectors and geographies. On upbizinfo.com/news.html, climate-related policy shifts, market reactions, and technological breakthroughs are framed in terms of their practical implications for executives, founders, and investors.

For marketing and brand leaders, whose work is explored at upbizinfo.com/marketing.html, climate communication has become a core dimension of reputation management. Claims about sustainability must be backed by verifiable data, aligned with emerging disclosure standards, and communicated in a way that resonates with increasingly sophisticated stakeholders across Europe, North America, Asia-Pacific, and beyond.

Looking Ahead: Climate, Capital, and the Future of Business

Now the direction of travel is unmistakable: climate change is redefining what it means for a business, a financial institution, or an economy to be competitive and credible. The contours of this new order are visible in the rapid growth of green finance, the mainstreaming of ESG metrics, the proliferation of climate-tech innovation, and the integration of climate risk into economic governance. Yet the pace and equity of this transition remain contested, with significant gaps between ambition and implementation, especially in vulnerable regions across Africa, South Asia, and parts of Latin America.

For the global audience from founders to investors and executives, the imperative is to treat climate not as a peripheral ESG topic but as a central strategic axis. Navigating this landscape requires a synthesis of financial acumen, technological literacy, regulatory awareness, and ethical clarity.

Across its dedicated sections on business, economy, investment, sustainable development, technology, and world affairs, upbizinfo.com aims to provide that synthesis-connecting climate realities to the decisions that shape markets, careers, and corporate strategies. As global finance, industry, and policy continue to evolve under the pressure of a warming planet, those who integrate climate resilience and low-carbon innovation at the heart of their business models will not only mitigate risk but also seize the most compelling opportunities of the next economic era.